Despite early 2020 projections by groups such as the Congressional Budget Office, a senior policy analyst at the Center on Budget and Policy Priorities has credited 2021’s quick economic recovery with sparing Social Security from short term financial disaster.

Now several months after the COVID-19 vaccines became widely available, states are quickly loosening travel restrictions and mask mandates, businesses are reopening and hiring, and workers whose jobs were affected by social distancing and stay-at-home recommendations are regaining their income.

With Americans returning to work and businesses beginning to operate at normal capacity and speed, Social Security’s payroll tax income will begin to stabilize. This sudden massive loss of payroll taxes was the biggest immediate threat to Social Security’s short-term finances. It looks like, for now, the worst of our economic woes are past us.

But for those affected by the COVID recession, optimism is proving far more difficult to revive. The public doesn’t forget hardship quickly, and our anxieties about what the future holds in a (hopefully) post-pandemic world are showing in the latest Social Security surveys.

Nationwide’s eighth annual Social Security Consumer Survey revealed 71% of the nearly 2,000 Americans participating believe Social Security could run out of funding in their lifetimes. Much of this fear can be directly attributed to the pandemic, with 59% of respondents saying they are more concerned about Social Security insolvency now than before COVID-19.

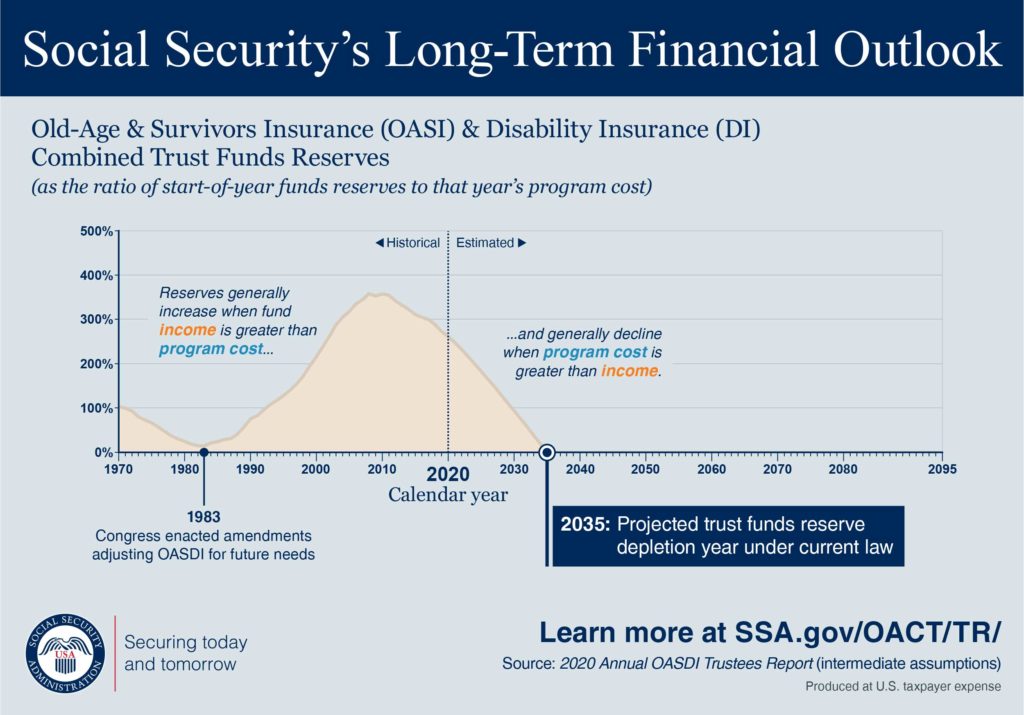

During the worst parts of our economic slump, worst case models showed the pandemic taking as much as three years off Social Security’s solvency. This would put the complete exhaustion of Social Security’s surplus reserves at 2031—in just ten short years.

We don’t yet have an official statement regarding COVID’s impact on Social Security’s funding from the Social Security Administration.

While we all want to believe we are nearing the end of this nightmare—and signs are certainly showing the vaccines are working—we aren’t out of the woods yet.

There are still tens of thousands of cases reported every week, according to the CDC. And in areas with low vaccination rates, the death toll is slowly increasing with the spread of variant COVID-19 strains.

For now, all vaccines available in the United States have proven resilient against the Delta variant (PLEASE get your COVID-19 vaccine if you haven’t already—Delta is EXTREMELY communicable and life-threatening).

Until we’ve achieved the 70-80% vaccination rates needed to declare herd immunity and eradicate this virus, we are still living in an uncertain environment. Not to mention, Social Security still hasn’t been inoculated against its existing funding problems, pandemic or not. This makes statements like:

“…the near-term finances of the federal government’s retirement and disability programs appear to have weathered the storm better than many policy analysts had predicted—taking some pressure off the Biden administration and Congress to reach a long-term solution to keep them solvent.”

…extremely frustrating.

If the SSA confirms no significant short-term damage has been done to the program, that’s wonderful news. But we’re still talking about the retirement benefits of millions of Americans getting cut by 2034. In the grand scheme of things, a quick economic recovery hasn’t changed Social Security’s dire funding problems.

And the LAST thing anyone should suggest is we allow the Biden Administration to ignore the problem just because the pandemic is slowing.