Social Security benefits can grow or shrink, depending on when we decide to claim them. Generally, the older we are when we claim our benefits, the higher our benefit will be. Deciding when to collect your Social Security can greatly affect your retirement. So, the question becomes, what time is right for me to claim my benefits? Trina Paul, reporting for CNBC, shares some insightful online Social Security tools that can help you decide what time is right to claim your benefits.

The Social Security Administration

The easiest way to find answers is to go to the source itself. The first of the online Social Security tools is the SSA’s own website. The SSA can provide online and in person services and makes it easy to create an account on their portal. The SSA website also has helpful calculators that can give you an estimate of future benefits, should you decide to file for the first time or suspend current Social Security.

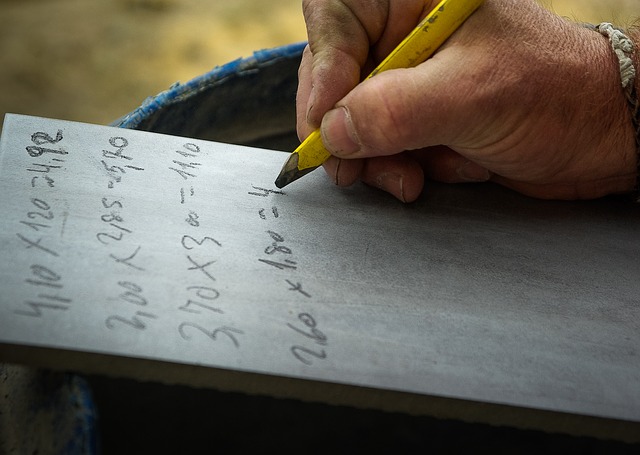

Third Party Calculators

As Trina writes, the SSA has a neutral stance on when seniors should claim their benefits. Not all situations are the same, and some seniors find themselves needing to claim before full retirement age. So, it’s always nice to have a second pair of eyes look over our math. Third party Social Security calculators are easy to find and make an excellent Social Security tool. For example, Open Social Security, MaxiFi Planner, and Bankrate.com are all tools that help you estimate benefits. By inputting you age, current income, expected income, and expected retirement age, as well as expenses, you can get a solid estimated amount of any future benefit.

Other Retirement Accounts

It may seem strange, but the last Social Security tool that can help you is another retirement account. Accounts like 401ks or Roth IRAs for example. Other retirement accounts have required minimum distributions that occur when you reach a certain age. Those distributions are tax-exempt if you are old enough to withdraw. They can help maximize your Social Security benefits by taking some weight off and sharing expenses. Seniors, especially those on fixed income, have a high cost of living, with expenses like healthcare growing exponentially. Having additional income in retirement can make you stretch your benefits further.

Regardless of the size of your benefits, the Council for Retirement Security is hard at work to protect the Social Security Trust. That way we can worry about maximizing our benefits, instead of worrying about whether they will be there at all.