Since January, we’ve seen record high inflation, due to the pandemic. The pandemic halted global supply chains for every day goods and services, and as a result demand and prices skyrocketed. This creates inflation, which decreases the value of the dollar. However, private industries don’t seem to be as effected by inflation as the rest of the world. Seniors now face high prices that outweigh their increased benefits, while private industries make record breaking profit.

News outlets like The New York Times, VOX, and Business Insider all report that most recent earning calls from several private industries have been nothing but positive. Which begs several questions: Are we paying more unnecessarily? Does consumer demand really affect pricing? And does high corporate pricing add to inflation? VOX’s Ellen Ioanes reports on the dynamic relationship between corporate pricing and inflation.

Corporate Pricing and Inflation: A Give and Take Relationship?

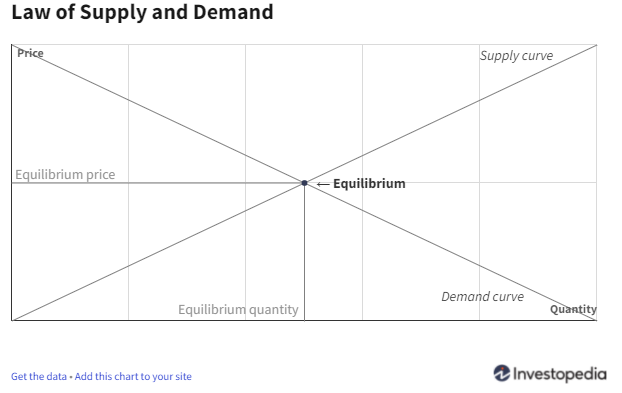

Let’s start with a quick Economics 101 review of the laws of supply and demand. Good and services are sold to meet consumer demand. Supply and Demand are intrinsically linked, one always effects the other. The law of demand states that high prices lower demand for a good or service; the law of supply states that higher process increase supply for a good or service. There are defining factors that shift supply and demand up or down and left or right. These two concepts interact to workout actual pricing for a good or service in any economy, as demonstrated by the supply and demand curve below:

So, consumers have shown that they are willing to pay higher prices for the things they want, but the math still seems off. With higher demand and limited supply, supply chain costs rise too. Normally, higher prices offset these costs so companies can make a profit. However, industries are seeing record high profits, up 27 percent from 2019, disproportionate to the costs they are incurring. This had led many to believe that the relationship between corporate pricing and inflation is not an honest one. Where as fixed-income seniors pay the price unnecessarily.

One Big Game of Monopoly

The situation we’re in is unprecedented for several reasons. Obviously the Covid-19 pandemic was described as a “once a century event,” forcing us to learn as we go in terms of economic recovery. Secondly, we haven’t had to deal with inflation this high in almost forty years, once again forcing us to set new rules to move forward.

Global economist Gregory Daco was quoted saying that price hikes have gifted companies with “stronger revenue and better evaluations, which means they would have little to no incentive to lower prices in the future, regardless of inflationary costs.” Companies can use pandemic-related inflation to justify their unequal price hikes, while a lack of competition lets them keep their prices high.

While there is active debate among politicians and economists about whether we’re facing market concentration, there is no doubt that there’s little to no competition in several industries. For example, in Oil, Meat, Transportation, and even Housing industries there are several dominating companies and very few new entries.

The term ‘Monopoly” means one company controls its market; that isn’t the case here. However, when large firms work together to seize control of an industry, it works the same way as a monopoly.

Corporate Pricing and Inflation: The Saga Continues

The Council for Retirement Security is working towards safeguarding the Social Security Trust. Social Security is every senior’s right, and issues like inflation but that benefit at risk. The relationship between corporate pricing and inflation is a tricky one, and seems very cyclical. Regardless, seniors shouldn’t have to pay obscenely high prices just to ensure corporate profits stay high. This story continues next week with “Corporate Pricing and Inflation: The Saga Continues” where we look at the potential political action we can take. Stay tuned.