The fight against inflation has been an epic saga to say the least. To date, the Fed has continued to increase interest rates as a mounting offensive. Unfortunately, inflation has also continued to prove itself a relentless enemy. So the battle rages on, as the Fed has hiked interest rates three-quarter of a percentage point, the highest in decades, CNN reports. What does this mean for the people caught in between the Fed and inflation?

More Interest Rate Hikes May Be Needed

A hike of 0.75 percent means that seniors are facing the highest interest rate in 28 years. The Fed released a critical report, stating inflation had remained resilient against their efforts. Interest rates had been increased by half a percentage point earlier in the year, with the Fed contemplating a plan of up to 10 hikes from now to the end of 2023.

The stock market is operating in a state of limbo. The market is in a state of decline, but stocks tend to react to the Fed’s actions positively. Talk of a potential recession has everyone worried. What would move the line is some real indication that inflation was slowing down. For that to happen the Fed is worried that interest rates will have to continue to rise. Until then, there is no end date for inflation.

Retirement Strategies

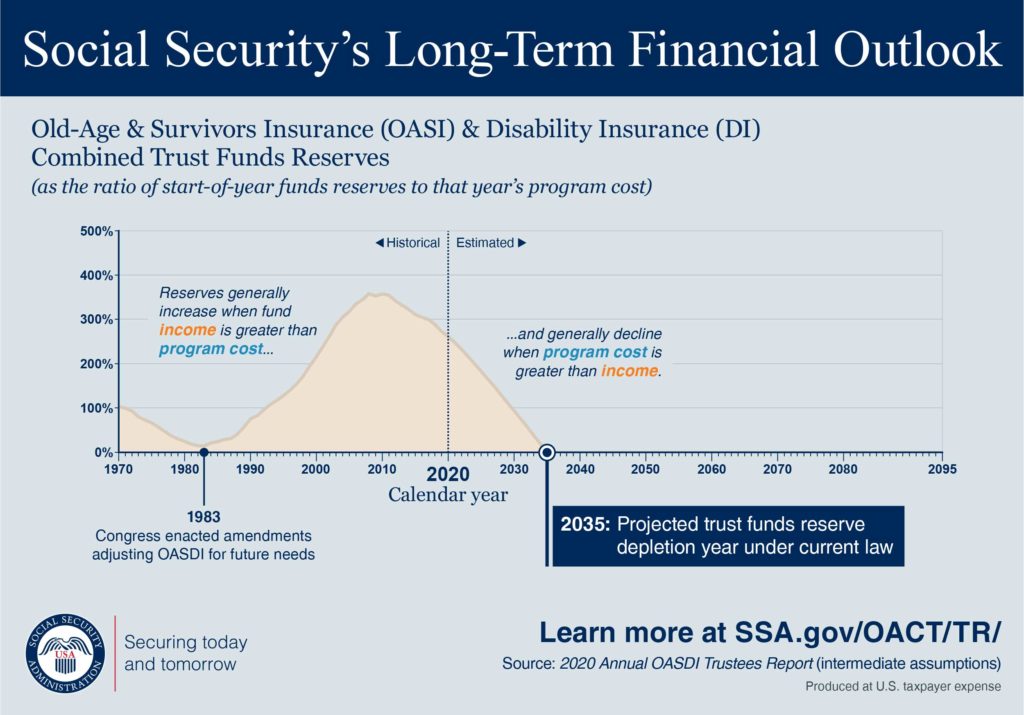

Seniors are at a disadvantage when it comes to interest hikes. A three-quarter hike means a higher cost-of-living adjustment (COLA )benefit, which depletes the Social Security Trust faster. Without that COLA hike, seniors still have to pay more interest. Luckily, seniors still have options. Prioritizing ways to save, creating diversifying forms of income (even in retirement), and being smart with taxes can help seniors fend off inflation.

Additionally, joining the Council for Retirement Security and demanding Congress prioritize protecting Social Security, can help seniors protect their finances. For all Social Security news and updates, follow the Council on Twitter and Facebook.