On Day One, the Biden Administration inherited an unenviable to-do list.

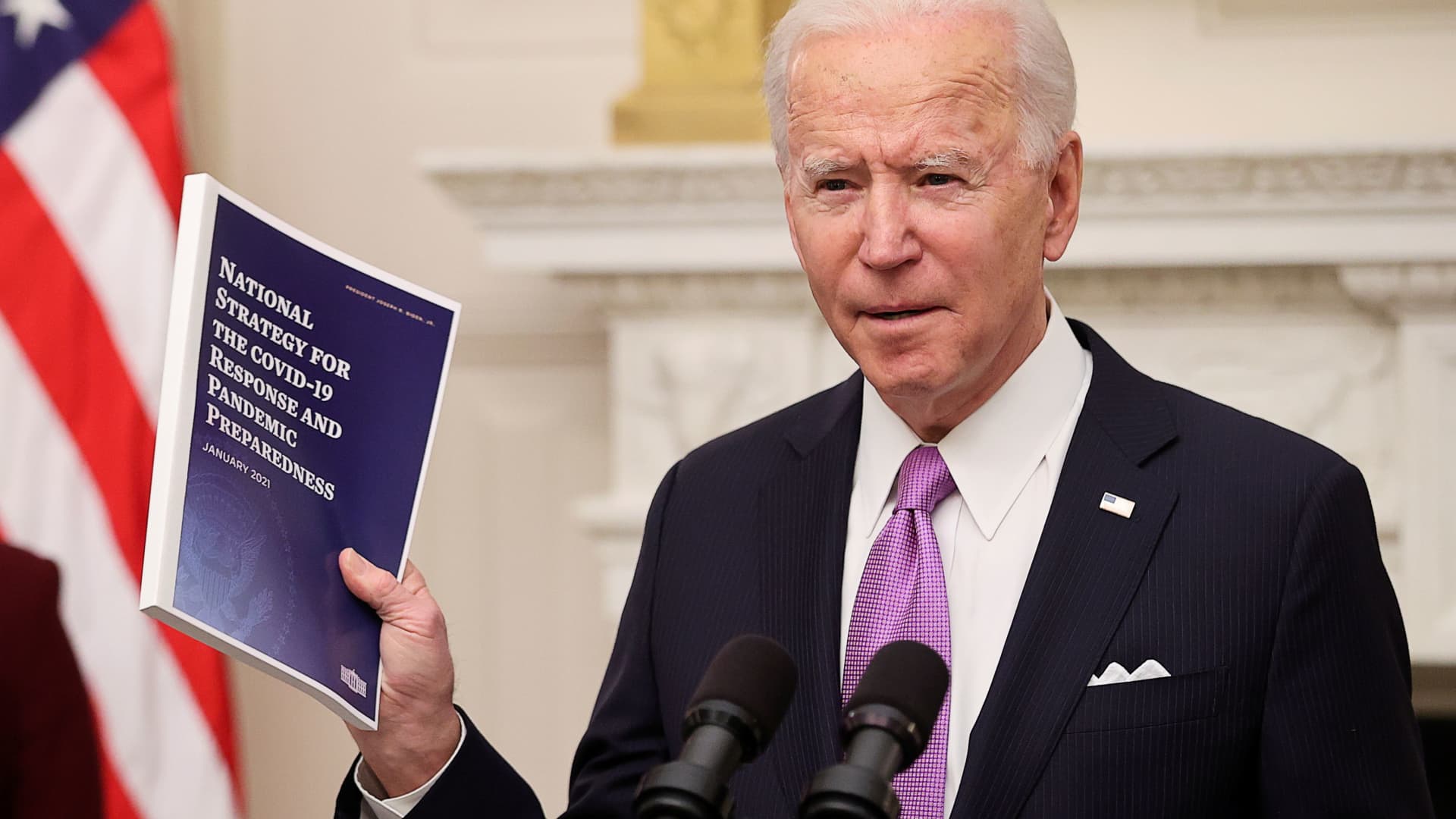

At the top of that list is taking immediate and aggressive action to control Coronavirus and the comprehensive damage it has done to our businesses, households, and national health. In his first three days, President Biden has signed 30 executive orders. Of those, 14 were about COVID-19.

Very few people would argue this isn’t the biggest First Days priority. With phase one vaccine roll outs ongoing, we have the tools to finally get this nightmare under control and focus on helping everyone this virus has hurt, medically, psychologically, and financially. Nothing is more important than that right now.

But once our plan is solidly in motion and the vaccine is fully and seamlessly accessible (boy, do we hope that’s sometime REALLY soon), we will need to look at the FULL scope of what has to happen to make sure everyone gets back to a place of financial security—and that means seniors, too.

The Biden Administration hasn’t yet made any moves on Social Security, but given the urgency of COVID-19, we don’t expect to hear too much about it in these first weeks.

So while we watch how this new Administration attacks its first major hurdles, we continue to think about the Social Security proposals it made on the campaign trail and how—and when—they might play out over the next four years.

Many sources are confident we could see the first actions on enacting Biden’s Social Security plan this year:

Bearing in mind these are merely proposals that will likely evolve should they make it to Congress, we’ve hunted down some very good, plain language explanations of how these proposals would directly impact retiree benefit amounts and extend solvency.

Working generations have certainly paid dearly because of the pandemic. Many unexpectedly lost their jobs without much in savings to get by and without immediate prospects for finding another job. In waiting for unemployment benefits to arrive, there are stories of young people accumulating tens of thousands of dollars in credit card debt.

In the flurry of these stories, we lose those about retirees and pre-retirees. Pre-retirees were devastated, citing huge losses in their portfolios that threw their near retirement plans straight into the garbage. And retirees, already suffering financial insecurity in large numbers, got a big dose of susceptibility to the virus, dealing with the inflated costs of…everything, and the likelihood of healthcare costs skyrocketing well into the future.

The reality for seniors is this pandemic ate into their fixed savings and income and threatens to continue driving up their costs long after this thing is over.

The primary solution for what seniors are experiencing is finally addressing Social Security. This is exactly the kind of situation the program was built to protect retirees from. Then it was the Great Depression, and today it’s the COVID-19 Pandemic. The Trust Fund was MADE for this.

A comprehensive post-pandemic restoration plan NECESSARILY involves Congress putting Social Security on the path toward real solvency—a number that should absolutely start at least 75 years—and if possible, considering all the ways we could make benefits and COLAs better while achieving that solvency.