When someone or something we care about is threatened, an all too common and unfortunate reaction is to look for something easy to pin the blame on.

Many of the myths we’ve broken down so far can be interpreted as simply that: a natural reaction to defend Social Security or create public concern by throwing someone under the bus. We’ve talked about myths related to immigrants, federal workers, and even political parties slurping money out of the Trust Fund and being the source of all of its problems.

The “who” that gets blamed is often politically convenient, but at the core, people who believe these things are largely looking to defend Social Security itself from criticism by pointing the finger at something else entirely.

But the problem with circulating these myths is it tends to do the exact opposite. If any and every small outside influence has such control over Social Security’s future, it doesn’t exactly make the program look as strong, dependable, and solid as we claim it is. That’s why talking about Social Security honestly and shattering these misconceptions is so important.

The people who ACTUALLY benefit from the circulation of Social Security myths are those who want Social Security to go away. And there are plenty.

But why would anyone WANT Social Security to go away?

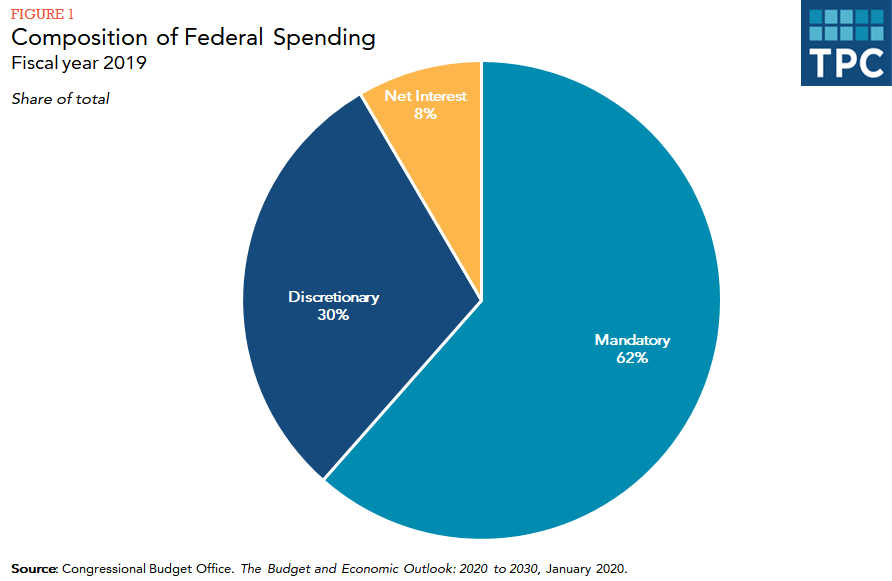

Because of this graph right here:

This is what federal budget generally looks like from year to year. There are two main categories of federal spending: mandatory and discretionary. Discretionary spending are things Congress chooses to spend money on each year. All discretionary spending requires Congressional discussion and approval.

Mandatory spending, on the other hand, is exactly what it sounds like. These are items that automatically come out of the federal budget. They are mandatory things the government has to pay for. More than half of all government spending is on these mandatory items.

So what types of things are considered mandatory spending?

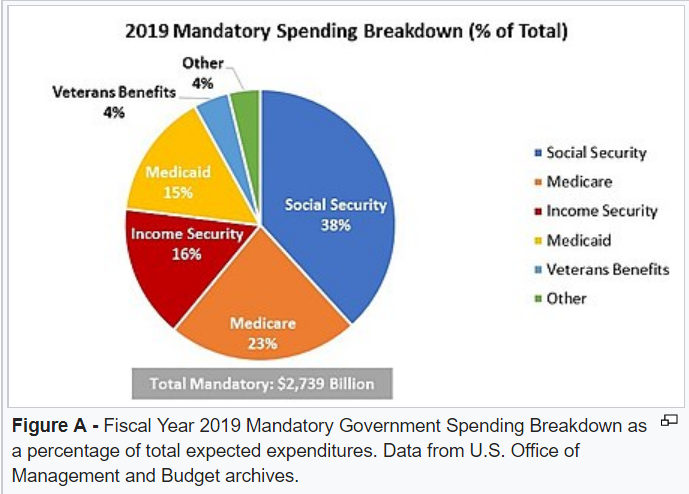

Entitlements. Mandatory spending is almost entirely comprised of entitlements, the largest piece of which is Social Security.

Looking at the complete federal budget and its obligations, it would appear the single largest source of debt in the United States is Social Security.

Social Security opponents want Social Security gone because it would eliminate the single biggest debt in the country. Additional criticisms about how it doesn’t work, pays millions out to people who didn’t earn it, and how it’s “going bankrupt anyway” are just adding fuel to the fire.

So let’s cut right to the core of the argument. Is Social Security the cause of our federal debt? What is Social Security’s relationship to the federal debt?

Here’s the simple answer: there is no relationship. Social Security is “off-budget.”

An off-budget program is one kept deliberately separate from the rest of the government’s accounting. It’s basically like putting a giant wall around certain programs so that they can’t be tinkered with along with other spending programs. It also means incoming and outgoing money can’t be reflected in the general budget (though many politicians include these programs in a “unified” budget model, which we’ll get to in a minute).

A major reason we can put Social Security off-budget is because it pays for itself. It’s funded almost entirely by past and current payroll tax contributions. The payroll taxes we contribute are a dedicated tax specifically to fund Social Security, while our income taxes pay for all other kinds of things.

Because Social Security has this dedicated source of revenue, it’s not competing for federal funds the way other programs are. It’s not causing us any debt. We contribute to the Trust Fund, and the money goes out to pay benefit obligations. Even now as we take out more for benefits than we contribute in payroll taxes, we are relying on surplus built up over the years to make up the difference. That money does NOT come from the general budget.

But if all that is true, where do these pie charts come from? How can anyone say Social Security is the Biggest Debt in the United States?

Because those pie charts illustrate a unified budget. And unified budget models include off-budget entitlement obligations.

Now, you may still be wondering how a program that pays for itself can represent a federal debt even in a unified budget. It’s already paid for, right? Social Security wouldn’t even function if taxpayers weren’t constantly contributing to the Trust.

Here’s where we get to one of the biggest Social Security myths of all—and the much more complicated explanation for why Social Security is said to be the biggest cause of our debt.

By law, all surplus payroll taxes not needed to immediately pay Social Security benefits is invested into Treasury securities. Treasury securities are a type of bond issued by the federal government and can only be redeemed by the federal government. These bonds accrue interest over time, which contributes more money into Social Security until such time as they need to be redeemed to pay benefits.

But ANOTHER thing they do is move all that surplus money into the general budget. It’s an accounting trick that converts payroll taxes designated for paying benefits into money that can be used for general spending.

While Social Security itself can’t be said to contribute to the federal debt, those Treasury securities absolutely DO represent a debt the U.S. government owes to the public. Those securities are essentially a giant stack of IOUs the government owes to Social Security.

This is the debt you’re looking at when you look at the unified budget. What appears to be a gigantic drain caused by Social Security is ACTUALLY money owed to Social Security because of its surplus being invested in Treasury notes.

Social Security is NOT causing our debt. At least, not fundamentally. The way the government is legally required to handle Social Security surpluses IS. Calling this the fault of Social Security as a program is disingenuous.

So take these claims with an entire LADEL full of salt. There is MUCH more to the story of the federal debt than simple pie charts often explain.