As we’ve been talking about over the last few weeks, the country is currently facing record-high inflation. It’s been the main focus because it is so historic, the highest inflation in 40 years. It’s lead many to worry about the economy as a whole and of the possibility for a recession, as the Fed announced that starting in March of this year, they would be raising interest rates. Inflation is not the only driving factor behind an economic recession; however, it doesn’t help. In our current situation it’s hard to understand how everything connects, especially inflation, recession, and higher wages. It all seems like bad news, but as MarketWatch’s interview with Mary Daly suggests, our worries might be worse than the situation itself.

What is a Recession?

Investopedia helps us clarify what a recession really is. Simply put, a recession is the decline of economic activity in a specific place. Originally, the economy must be in general decline for two consecutive fiscal quarters, or six months in layman’s terms, to be in a recession. Under new guidelines set by the National Bureau of Economic Research, a recession is a substantial decline across the whole economy over a period of a few months, specifically in the areas of GDP, real income, retail, and employment.

Like inflation, recessions are a normal part of any functioning economy. Recessions are caused by many things, such as industries losing momentum or shifting, changes in public policy, or wide-spread unemployment caused by pandemics. Unfortunately, there is no single way to predict a recession.

The Fed’s Perspective

Mary Daly is the president and CEO of the San Francisco Federal Reserve, so while her opinion holds some weight, she doesn’t represent the Fed as a whole. That said, her outlook is optimistic. Daly states that the way current Fed’s transparency in this inflation issue is beneficial and promotes cooperation. The Fed is the best suited organization to handle inflation, and Daly is in support of raising interest rates. Raising interest rates make it harder to borrow money, thus lower demand in an economy. Lowering demand will eventually low prices and regulate the economy.

Daly states that this record inflation is due to the pandemic, and that high demand and low supply will even out as we recover more and more. The Fed will most likely continue with its plan to raise interest rates, despite any political elections or the ongoing border dispute between Russia and Ukraine.

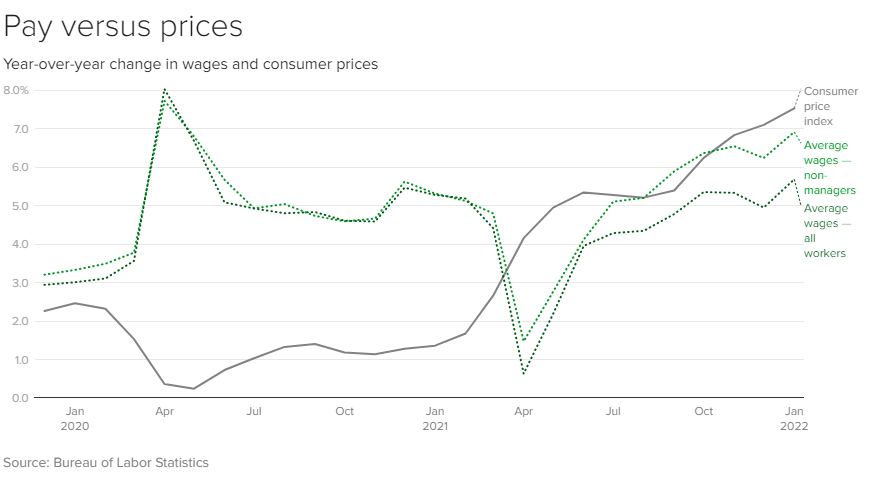

Inflation, Recession, and Higher Wages

Many people cite higher wages as a cause of inflation, which lead to higher interest rates that create a recession. It’s easy to see how you’d conflate these topics and assume that they affect each other in this way. However, that argument lacks nuance. As CBS News’ Irina Ivanova reports, the current sources of inflation are cars, fuel, housing, and furniture, not higher wages. Economic data shows that labor-intensive sectors of the economy are experiencing less inflation than product-intensive sectors. That means the high demand for goods and the low supply are driving inflation, rather than increasing wages for workers.

The idea that higher wages and inflation are linked stem from the 1960s’ economy. In the ’60s globalization was in its infancy, and labor unions were more in control of productivity. That poorly reflects today’s modern economy which operates on a global scale.

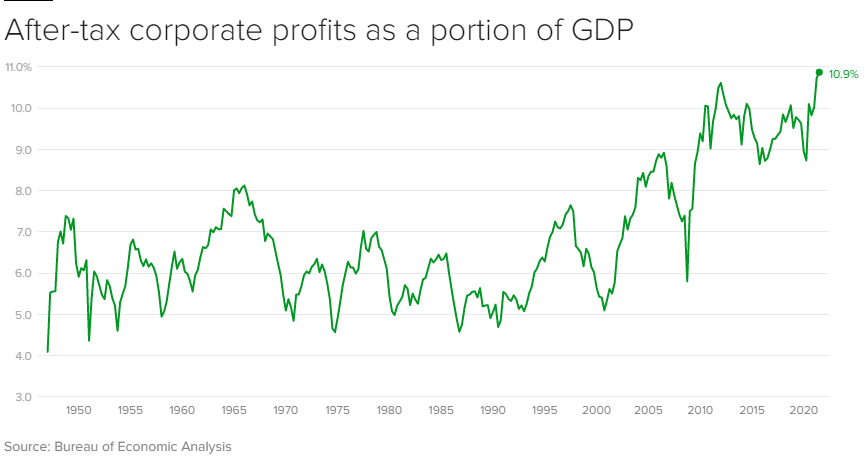

One thing that is contributing to higher prices are corporate profit margins. Private sector industries, especially those that are experiencing an impaired supply, have been able to raise their prices considerable to meet demand. Higher demand means higher prices, and without regulation, private industries can hike prices as they see fit.

As the Fed makes borrowing money harder, demand will slow; however, demand can not cease completely. People still need to be able to buy essential services and pay their bills. When people have money, they typically spend it, which can lead to inflation, but it’s hardly the only cause. If a country is in a recession, higher wages can help increase economic activity, and social programs, like Social Security. The Fed will regulate interest rates and make it harder for people to buy specific things, which will slow the economy. Higher wages will help make sure that slowed economy doesn’t halt completely.

What’s Next?

There is no way to predict the future. Our only way to get through this it to get through it. When looking at the bigger picture, positive attitudes like Mary Daly’s spark optimism. But as regular Americans just trying to get by, we can’t help but worry about our own finances. Seniors on benefits or fixed incomes need to be aware of the higher costs they might face. Seniors that are on benefits, with other sources of income, should be aware of how inflation is going to affect them.

Retirement is expensive, but it should not be impossible. The Council for Retirement Security is working to protect the Social Security Trust and ensure each American receive their full benefit. So regardless or inflation, recession, and higher wages, seniors can rely on their Social Security when they need it.