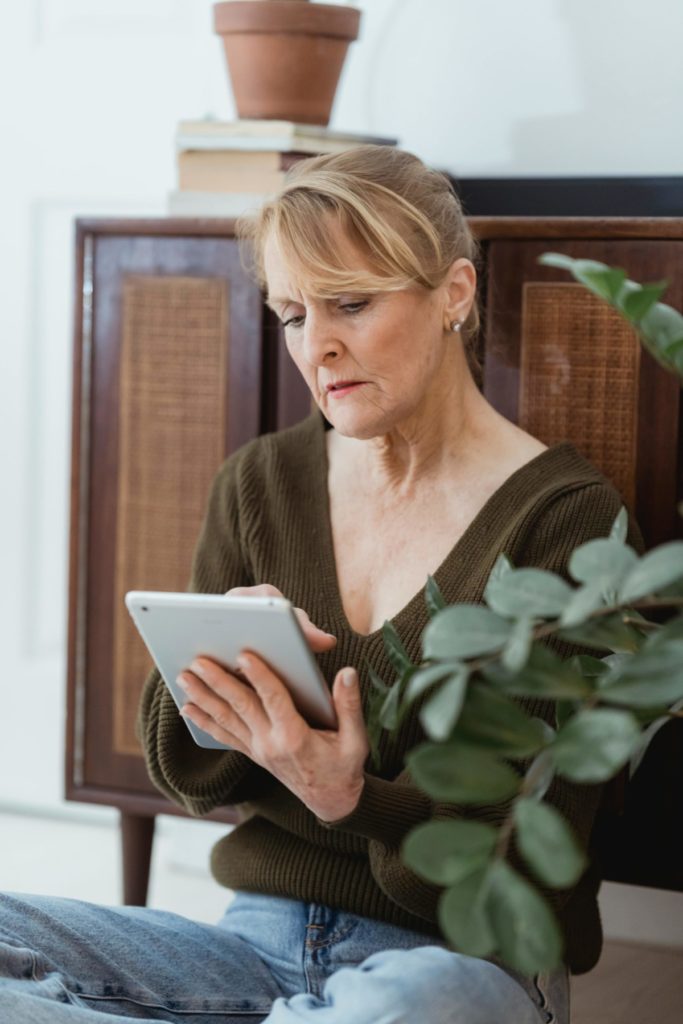

Social Security clawback incidents have remained in the spotlight for well over a year, capturing headlines and public attention alike.

Following instances where the Social Security Administration (SSA) mistakenly overpaid numerous seniors, a significant number of them found themselves obligated to return the excess funds.

However, many affected seniors were unaware of these overpayment errors, leading to a distressing situation where they were suddenly burdened with repayment demands amounting to tens of thousands of dollars.

Consequently, numerous seniors faced the suspension of their Social Security benefits, plunging them into financial and personal turmoil. Nonetheless, a recent reform aims to inject a degree of humanity and fairness into these clawback procedures.

Could This Reform Ease the Burden for Some Seniors?

The saga of clawbacks and the overpayments triggering them is a deeply frustrating one, marked by varying degrees of severity across different cases. As documented extensively, some seniors have found themselves grappling with homelessness while endeavoring to repay mistakenly issued funds.

The current head of the SSA has been vocal in criticizing the previous procedures governing Social Security clawbacks. The SSA is already implementing reforms. A new rule caps repayment limits at 10 percent of Social Security benefits.

While the issue of significant administrative errors remains unresolved, this measure is expected to alleviate some of the pressure on affected individuals.

Furthermore, efforts are underway to address the root causes of these overpayments and subsequent clawbacks. Proposed policy changes in payroll reporting hold promise for significantly reducing the occurrence of errors that lead to such overpayments.

What are your thoughts on the steps being taken to address Social Security clawback issues? Have you or anyone you know been impacted by this issue? Feel free to share your insights with us in the comments section below.