In this ever-changing financial climate, where inflation is ramping up prices and Social Security’s future is uncertain, the idea that we would just know how much we’d need to retire is an unrealistic expectation. As the economy changes, so do our financial needs. To stay on top of those changes, we need help and guidance. That’s where a retirement calculator can be an amazing tool, helping us get an idea of what we need to save. However, are retirement calculators enough?

Retirement Calculators

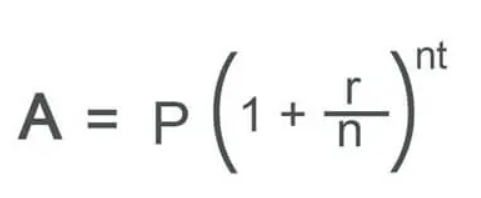

Retirement calculators are fantastic tools. A retirement calculator works by collecting several variables centered around your financials and inputting them into a financial formula. That formula is most likely a compound interest formula, like so:

The input variables include:

- A= the final amount of compound interest

- P= the initial amount you invest in a retirement savings account

- r= the initial interest rate

- n= the number of times the interest rate is compounded

- t= the number of years you invest

Let’s put it into practice. For example, if you had an initial investment of $2,000 and the current interest rate is 16 percent. Let’s assume that the interest rate is compounded twice a year, meaning that “n” will be equal to 2. Furthermore, let’s assume you actively invest in this account for 5 years. Next, we do the math:

A= 2000(1 + (0.16/2)) ^(2×5)

A= 2000(1 + 0.08) ^10

A= 2000 x 2.158

A=4,317.84

So, after 5 years, if the interest rate stays consistent, you should see a return of over $4,300. Changing these variables to fit your financial situation can help you get a better understanding of your retirement saving needs.

Does One Calculator Fit All?

The question raising concerns about retirement calculators is whether its formula is too generic. Standard compound interest formulas provide a wealth of information, but don’t necessarily help the individual retiree understand how their current assets can work together. Factoring in benefits, pensions, other types of retirement accounts, investments, and assets can help paint a whole picture when it comes to planning for retirement.

A study on the effectiveness of retirement calculators, as reported by MarketWatch’s Robert Powell, showed that people who were already saving for retirement benefited more from a retirement calculator than those that were just starting to save.

Finances are tricky, and it can be dangerous if we work without knowing all the variables. Those that had a history of saving, and who were considered more “financially experienced” were able to save a couple hundred dollars more a year on average.

There are different types of retirement calculators out there, ones that look at pensions and 401(k)s, however, if you don’t know where to start it’ll be hard to know which calculator can help you. The best course of action is to work to list your assets:

- Know your exact benefit

- Be aware of how inflation impacts your savings

- Know how much your other assets/ income streams are worth

Once you have everything organized, seek out the advice of a financial professional. A financial advisor, an accountant, or a financial institution will be able to build your portfolio, so you know exactly what you have and, more importantly, understand what you need.

In the meantime, use a retirement calculator to help you get an idea of what you need while you plan for your retired future.

For more retirement tips and tricks, follow along with the Council for Retirement Security.